With the fifth-most significant economy in the country, beginning a company in Illinois is a good selection for business people. Start out your company today with our very simple stage-by-phase information and get on the quick keep track of to fiscal and individual independence.

Stage 1: Choose the Ideal Small business Thought

The 1st move toward business enterprise possession is selecting what sort of business enterprise to get started. Glimpse for an idea that suits your interests, your individual aims, and your organic talents. This will help you keep motivated when the going gets challenging and will drastically strengthen your odds of results. We have assembled a in depth record of small business enterprise tips to enable you get commenced. Require inspiration? Below were being the most preferred concepts among our Illinois visitors in 2020:

- Drive-In Motion picture Theater

- Grocery Keep

- Towing Enterprise

- Outfits Boutique

- Gas Station

- Stability Guard Business

Action 2: Prepare Your Illinois Business

Productive firms are constructed as a result of careful preparing. Right before committing a sizeable amount of money of money and other assets towards your business in Illinois, critically assess your strategy, and build a sport program. At a minimum, you ought to complete the next:

Identify Your Small business

What will you name your company? When naming a business, you'll want to select an obtainable name that follows Illinois&rsquo naming policies for an LLC or corporation and resonates with your clients. Use our Business Identify Generator to come across the excellent brand name identify and site.

Discover a Business enterprise Spot

Do you know where by your organization will be found? No matter whether you&rsquore opening a brick-and-mortar institution or starting up a company from household &mdash your company place informs the form of licensing and permits you&rsquoll require as perfectly as your company&rsquos expansion likely. Performing your analysis on Illinois&rsquo popular spots this sort of as Chicago or Rockford can enable maximize foot targeted visitors and travel client fascination.

Perform Market Exploration

Have you gotten to know your market place? Prior to you publish your small business strategy, conducting complete current market exploration is very important. check here can involve conducting surveys, doing search motor optimization (Website positioning) investigation, or keeping target groups. The purpose of industry investigation is to greater comprehend your target industry and competition in get to craft an effective company prepare.

Compose a Small business Approach

Have you penned a company system? Our Business Strategy Generator makes producing your organization system a lot easier than ever just increase your company&rsquos info and you&rsquore done!

A effectively-crafted company strategy doesn&rsquot just assist you get arranged though you start off your small company in Illinois. Business enterprise options are applied to receive small business funding and assist you access important milestones.

In this article are some of the main factors of a very well-penned organization plan:

- Item Progress: What trouble does your business solve? What will set your product or service aside from the competitors?

- Income & Marketing and advertising: Who are your likely shoppers? How will you get their awareness and transform them into buyers?

- Persons & Partnerships: What roles will you need to have to employ the service of, and what professional interactions will you need to kind in get to succeed?

- Monetary Preparing: How quite a few shoppers or sales will you need to have in purchase to crack even? How considerably revenue will it choose to get there, and wherever will you get the funding?

Small business Planning Means

- Need Support? Find organizations in your community space that can help you with scheduling.

- If you&rsquore a female in enterprise, obtain funding, instruments, and sources with this excellent Women in Organization series.

Action 3: Get Funding

It&rsquos no key that you want funding to start off a organization, but prior to you can secure the funds you have to have to deal with startup charges, there are a several matters you have to have to do initially. Determine your small business expenditures ahead of trying to find outside the house funding. This will assist you pick the suitable funding source for your Illinois enterprise&rsquos wants. Up coming, be good with your investing and get organized by creating a detailed money plan.

Check out Enterprise Funding Choices

- Bootstrapping: This is the do-it-you technique to business funding which usually means you deliver the money for your organization as a result of particular discounts as very well as your present-day income. After your enterprise is in procedure, income is reinvested back again into the business enterprise to continue on its development.

- Close friends and Spouse and children: Financing your business enterprise through close friends and household loans can be a great way to get the money you need to start off your smaller business enterprise. When mixing company with family members and close friends, it&rsquos a excellent strategy to create a written agreement and repayment program.

- Tiny Enterprise Grants: Small enterprise grants are effectively enterprise funding for your small business you don&rsquot have to spend again. You can obtain a compact business enterprise grant by completing an software system with a grantor.

- Smaller Company Loans: You can typically use for small organization loans through a bank or other lending establishment. This funding method calls for compensation but will offer you with the cash to include startup fees or a lot more.

Phase four: Decide on a Small business Structure

Registering your Illinois firm as a legal enterprise entity &mdash such as an LLC, company, or nonprofit &mdash has two important strengths:

- Enhanced reliability

- Safety from particular liability in the celebration your business enterprise is sued

Locate out which business composition is proper for your new business in Illinois.

Sole Proprietorship

A sole proprietorship is an casual company framework that isn&rsquot integrated or divided from its operator. This means that 100% of the business enterprise&rsquos earnings go to the operator even so, a hundred% of the monetary legal responsibility should the company accrue debt or get sued falls on the owner as very well.

Partnership

A partnership, like a sole proprietorship, is an casual unincorporated business composition but with a number of homeowners. Likewise, partnerships do not have legal responsibility defense that you locate with a official business enterprise structure.

LLCs

A limited legal responsibility organization (LLC) combines the private asset protection of a corporation with the adaptability of a partnership or sole proprietorship. Most small enterprises want the LLC structure because of to its simple maintenance and favorable tax remedy. Find out if you should start an LLC for your little enterprise.

Businesses

A corporation is a individual authorized entity that is owned by its shareholders. Businesses have extra official laws than LLCs and are inclined to be a lot more desirable to investors. Most significant corporations like Apple drop below the corporate group.

Nonprofits

A nonprofit business is one particular that is funded by donations rather of traders. Nonprofits are generally developed to more a social trigger and are exempt from paying taxes. The Pink Cross is an example of these kinds of an corporation.

If you choose not to register your firm as a company entity, you will be held personally responsible for the money owed and liabilities of your business enterprise.

In addition, partnership and sole proprietorship organization proprietors may well need to have to file a DBA, recognized in Illinois as an assumed name. A DBA is not a enterprise composition and does not give you and your personal possessions the security like an LLC would.

Stage 5: Sign-up Your Illinois Enterprise

The moment you&rsquove preferred your business composition, the future phase is to variety your small business. No subject what official company composition you pick, there are a couple of common ways, like:

- Naming your business

- Picking a registered agent: an specific or business enterprise entity that accepts tax and authorized paperwork on behalf of your business enterprise.

- Having an Employer Identification Quantity (EIN): a number assigned by the Internal Earnings Assistance (IRS) to support establish corporations for tax reasons.

- Filing development documents.

In addition to these techniques, each enterprise construction has its possess demands that are unique to that company structure.

Here are the measures you need to have to get to sign up your organization:

Sort an LLC in Illinois

LLCs are the most basic formal business enterprise structure to form and maintain. With considerably less paperwork than other business enterprise buildings, you can easily form an LLC in five simple measures.

- Identify Your LLC

- Decide on a Registered Agent

- File Your LLC With the Point out

- Create an LLC Running Agreement

- Get an EIN

If you think starting a corporation is right for your small business, there are 5 steps to starting up your small business as a company. Moreover, you&rsquoll have to have to come to a decision the sort of company your company will be, these kinds of as a C corporation or S company.

- Identify Your Company

- Decide on a Registered Agent

- Hold an Organizational Assembly

- File Formation Files

- Get an EIN

To file the Articles of Incorporation for a corporation in Illinois, you ought to file your formation documents to the Secretary of State online or by mail along with the $one hundred fifty submitting price.

Form a Nonprofit in Illinois

Deciding upon to form a nonprofit involves several of the similar actions as a corporation or LLC nonetheless, with this enterprise structure, you can utilize for tax exemption, otherwise regarded as 501(c)(3) status, via the IRS.

- Title Your Nonprofit

- Opt for a Registered Agent

- Pick out Your Board Members and Officers

- Undertake Bylaws and Conflict of Interest Coverage

- File the Articles or blog posts of Incorporation

- Get an EIN

- Apply for 501(c)(three) Standing

To file Articles of Incorporation for a nonprofit in Illinois, you should file your formation documents to the Secretary of Condition online or by mail alongside with a $fifty submitting fee.

Phase 6: Established up Company Banking, Credit history Cards, and Accounting

Employing committed company banking and credit rating accounts is essential for individual asset security.

When your personal and business accounts are blended, your private belongings (your household, motor vehicle, and other valuables) are at risk in the party your company is sued. In enterprise legislation, this is referred to as piercing your corporate veil.

You can shield your Illinois small business with these a few ways:

one. Opening a business bank account:

- Separates your particular assets from your corporation's assets, which is essential for individual asset safety.

- Can make accounting and tax submitting simpler.

To file the Articles of Corporation for an LLC in Illinois, you will have to post your formation documents to the Secretary of Point out online or by mail together with the $150 submitting price.

two. Acquiring a business credit rating card:

- Helps you individual private and organization expenses.

- Builds your business's credit rating historical past, which can be beneficial to elevate capital (e.g., small organization loans and small small business grants) later on on.

3. Location up enterprise accounting

An accounting program helps you keep track of the performance of your business and simplifies yearly tax filings. Good quality accounting software program allows you download your lender and credit history card transactions, producing accounting rapid and effortless. Learn much more about the importance of accounting and how to get began with accounting these days. Or, hire a enterprise accountant to enable you navigate all your company accounting and tax wants from payroll to sales tax.

Stage 7: Get Insured

Enterprise insurance policy helps you take care of risks and concentrate on growing your business in Illinois. The most typical kinds of company insurance you really should take into account are:

- Normal Legal responsibility Insurance

- Staff&rsquo Compensation Coverage

- Professional Legal responsibility Insurance

We propose that all smaller companies, which includes household-dependent companies, invest in a basic legal responsibility coverage. Firms offering professional advice or services, these types of as consulting and accounting companies, need to also contemplate a expert liability plan.

In Illinois, firms with just one or far more workforce, such as LLC associates and corporate officers, are demanded by legislation to have employees' payment insurance plan.

Phase eight: Acquire Permits and Licenses

To work your new organization lawfully, you will need to comply with federal, condition, and local federal government restrictions. In many scenarios, this will involve acquiring one or far more business enterprise permits and/or licenses. For illustration, a restaurant will very likely have to have health and fitness permits, setting up permits, signage permits, and many others.

To start a enterprise in Illinois, you&rsquoll require distinctive licenses and permits relying on the sort of small business you&rsquore functioning. Uncover out the licensing your business needs by performing a business license search or by utilizing the subsequent assets:

- Federal: Use the US Compact Small business Administration (SBA) tutorial.

- Condition: Visit the Illinois Registration, Licenses, & Permits webpage.

Stage nine: Hire Staff

For any small business (except you system to be your small business&rsquos sole personnel), building a strong crew is a critical subsequent action in commencing a thriving small business. But it isn&rsquot just about finding the suitable individuals you have to have to be certain you keep compliant with requirements for hiring staff members lawfully. This incorporates making sure that you are registered with the IRS for employee taxes and reporting new hires to the State of Illinois.

Step 12: Encourage and Current market Your Business

Promoting Your Illinois Organization

There are several various techniques to endorse your small business in Illinois, but the most helpful approaches are:

- Press Releases

- Fb

- YouTube

- Google My Organization

Push Releases

Push releases are a terrific way to endorse your brand and are a person of the most price-successful techniques as they:

- Gives publicity

- Set up your brand name on the website

- Make improvements to your web-site's Website positioning, driving extra clients to your web site

- Are a one particular-time charge in conditions of energy and dollars

Action 10: Determine Your Brand

The strongest and most unforgettable organizations are built on a sound brand. When acquiring your brand name, you should really contemplate:

1. Decide on a Company Idea

Choose time to discover and research tips for your company. At this phase, consider into thought your personal pursuits, abilities, assets, availability, and the good reasons why you want to type a organization. You really should also examine the likelihood of accomplishment based on the interests of your neighborhood, and irrespective of whether your enterprise notion will meet up with an unmet will need. Read through our report for additional guidelines on how to evaluate small business ideas.

Just after you select an strategy, take into account drafting a business program to establish your likelihood of making a profit. When you develop a approach, you will have a improved plan of the startup prices, your competitors, and tactics for making revenue. Traders and loan companies will want to overview your small business approach prior to providing money help, and you can be prepared by drafting a program just before you start off soliciting funding.

2. Make your mind up on a Legal Structure

The most prevalent lawful constructions for a smaller organization are:

- sole proprietorship

- partnership

- minimal liability organization (LLC), and

- company.

There also are specific versions of some of these constructions, such as restricted partnerships and S companies. You'll want to contemplate which small business entity framework provides the type of liability security you want and the ideal tax, funding, and money gains for you and your company. Read our article for information and facts on how to pick out the most effective possession structure for your company.

3. Select a Name

For LLCs and firms, you will want to look at that your identify is distinguishable from the names of other business entities now on file with the Illinois Secretary of Condition (SOS). You can examine for available names by executing a name search on the SOS site. You can reserve an out there name for 90 times by submitting an Software for Reservation of Title. There are sure name necessities for LLCs and businesses (like such as a term these kinds of as "LLC" for LLCs or "Company" for organizations). See How to Type an LLC in Illinois and How to Variety a Company in Illinois for more facts.

Is your business a sole proprietorship or partnership that uses a business name that is distinct from the authorized identify of the enterprise proprietor (for a sole proprietorship) or surnames of the individual partners (for a partnership)? If so, you need to register an assumed company name with the county clerk in the county where by you transact organization. In addition, you ought to publish your assumed identify submitting. Examine the website for the applicable county for far more info.

If you approach on undertaking business enterprise online, you may want to sign-up your small business name as a domain name. See Pick and Register a Area Identify for more facts. In addition, to keep away from trademark infringement issues, you ought to do a federal and point out trademark test to make guaranteed the name you want to use is not the similar as or also comparable to a title previously in use. See How to Do a Trademark Research for extra information and facts.

4. Develop Your Organization Entity

- Sole proprietorship: To create a sole proprietorship in Illinois, you don't will need to file any organizational files with the condition. For additional information and facts, see How to Create a Sole Proprietorship in Illinois.

- Partnership: To generate a basic partnership in Illinois, you don't want to file any organizational documents with the condition. Even though not legally required, all partnerships should have a written partnership settlement. The partnership settlement can be very valuable if there is at any time a dispute among the the associates. For extra data, see How to Type a Partnership in Illinois. To sort a minimal liability partnership (usually utilized by industry experts), you should file a Assertion of Qualification with the Illinois SOS. For a lot more info, see How to Type a Confined Legal responsibility Partnership in Illinois.

- LLCs: To create an LLC in Illinois, you ought to file Articles of Business with the Illinois SOS. You will also need to have to appoint a registered agent in Illinois for services of method. In addition, whilst not expected by legislation, you need to put together an operating agreement to establish the essential regulations about how your LLC will run. The working arrangement is not filed with the condition. For much more information and facts, see How to Variety an LLC in Illinois and How to Type a Professional LLC in Illinois (for industry experts).

- Businesses: To build a company in Illinois, you ought to file Articles of Incorporation with the Illinois SOS. You will also need to have to appoint a registered agent in Illinois for company of procedure. Although not lawfully demanded, you also must prepare bylaws to build your corporation's interior functioning procedures. Bylaws are not submitted with the point out. S Organizations need to also file IRS Kind 2553, Election by a Smaller Enterprise Corporation, with the IRS. For much more info, see How to Kind a Company in Illinois.

5. Use for Licenses and Permits

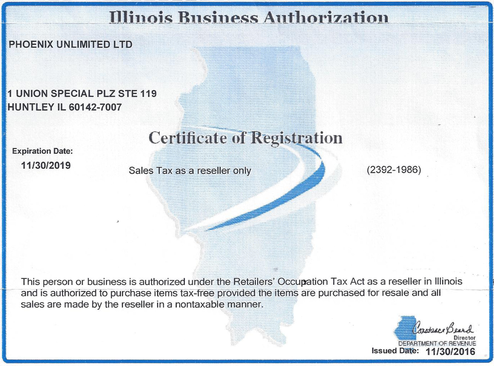

Tax Registration. If you will be promoting goods in Illinois, you have to sign-up with the Division of Revenue (DOR) to obtain income tax. If your business will have staff members, you should sign up with the DOR for employer withholding taxes. You can register for both styles of tax, as effectively as other business enterprise taxes, either on the web via the MyTax Illinois website or on paper using Form REG-1, Illinois Company Registration Application.

EIN. If your enterprise has workforce or is taxed independently from you, you will have to get hold of a federal Employer Identification Quantity (EIN) from the IRS. Even if you are not required to obtain an EIN, there are frequently organization explanations for carrying out so. Banking companies normally demand an EIN to open up an account in the business's name and other businesses you do business enterprise with may perhaps call for an EIN to course of action payments. You can get an EIN by completing an on-line application on the IRS web page. There is no submitting charge.

Regulatory licenses and permits. These can go over areas these types of as:

- health and fitness and basic safety

- the environment

- constructing and development and

- precise industries or solutions.

LLCs. Members pay condition taxes on their share of LLC income on individual tax returns. In addition, LLCs by themselves have to file an supplemental condition tax form &mdash both a partnership return or a company return. The unique kind employed will rely on how the LLC is labeled for federal tax needs. Illinois LLCs also are necessary to file an annual report with the Illinois SOS. See Illinois LLC Once-a-year Filing Prerequisites for far more details.

Organizations. Shareholders ought to pay out condition taxes on their dividends from the company. A shareholder-personnel with a salary also have to shell out state money tax on his or her individual state tax return. In addition, the company itself is subject matter to several Illinois corporation taxes. And, lastly, corporations need to file an annual report with the Illinois SOS.

If you have staff members, you have to also offer with point out employer taxes.

And, apart from Illinois taxes, there are often federal earnings and employer taxes. Check out IRS Publications 334, Tax Information for Modest Small business, and 583, Taxpayers Beginning a Company, accessible at irs.gov.

8. Get hold of Insurance plan

Enterprise insurance policies can guard your business and your personal belongings from the fallout of surprising disasters, these kinds of as personalized damage lawsuits and organic catastrophes. An insurance coverage agent can support you take a look at the distinctive protection possibilities for your business enterprise, which may include things like normal legal responsibility coverage to secure you in opposition to claims relating to bodily personal injury or house harm, or cyber liability insurance policies to go over litigation and settlement costs subsequent a data stability breach. To find out a lot more, see Nolo's post, What Kinds of Insurances Does Your Tiny Organization Require?

nine. Open up a Enterprise Bank Account

No issue the form of company you variety, you really should look at opening a independent business account to make it simpler to keep track of your cash flow and fees. If visit their website with confined legal responsibility, these as an LLC or a corporation, you need to open up a separate lender account to manage your liability protection. To discover far more, see Opening a Business enterprise Bank Account.

Distinctive regulatory licenses are issued by diverse state businesses. For instance, environmental permits may perhaps be issued by the Illinois Environmental Security Agency and employment-similar licenses may perhaps be issued by the Illinois Department of Labor. Check the Registration, Licenses, & Permits section of the state authorities's illinois.gov web site for much more data. For info about neighborhood licenses and permits, examine the web sites for any metropolitan areas or counties in which you will do business enterprise.

Specialist and occupational licenses. Many professions and occupations are regulated by the Illinois Division of Financial and Professional Regulation (IDFPR). The IDFPR web site has a area covering Professions Controlled by IDFPR. Just about every occupation and occupation also is more straight regulated by its connected state regulatory board.

6. Pick a Business Site and Verify Zoning Restrictions

You'll want to choose a area for your small business and check out community zoning rules. Before you dedicate to a site, take time to work out the prices of working your small business in the wanted spot, together with lease and utilities. You can refer back to your business enterprise plan to appraise regardless of whether you can manage your wanted locale during your corporation's early months. You must also be certain to confirm that the location is zoned for your type of small business. You may possibly uncover zoning laws for your city or metropolis by reviewing your area ordinances and speaking to your town's zoning or scheduling section. Examine our post for more strategies on finding a spot.

1 different to opening your organization at a new site is managing your firm out of your household. If you choose to operate a residence-centered enterprise, again examine your local zoning guidelines. In addition, assessment your lease (if you lease your residence) and homeowners affiliation rules (if relevant), possibly of which might ban some or all house companies.

seven. Evaluation Your Tax Registration and Reporting Prerequisites

Illinois taxes every single kind of small business. Far more precisely, Illinois has a corporate income tax, a corporation franchise tax, and a individual residence replacement tax. Most firms (other than sole proprietorships) will be matter to at minimum 1 of these 3 taxes. See Illinois Condition Organization Earnings Tax for extra information on point out organization taxes in Illinois.

Sole proprietorships. Pay condition taxes on business enterprise earnings as section of their private state profits tax returns (Type IL-1040).

Partnerships. Partners spend point out taxes on partnership income on own tax returns. In addition, Illinois partnerships also should file Form IL-1065, Partnership Alternative Tax Return.